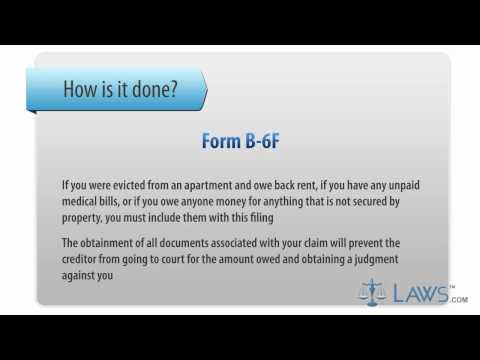

Laws.com legal forms guide Schedule F on Form B-6 is the most important form for those seeking to eliminate consumer or medical debts. The debts listed on Schedule F include unpaid personal loans, credit card debts, medical bills, bills for services rendered, and any other debts secured by property. To expedite the filing process of Form B-6 Schedule F, you need to follow these steps: 1. Collect the required information: Start by gathering information about your personal debts and medical expenses. Have your most recent credit card statements on hand. If you're unsure about the amount of debt owed or the number of creditors seeking collection, obtain a credit report that shows all your accounts. Make sure to list every non-secured creditor on Schedule F. Additionally, go through your records for any non-consumer bills, such as back rent from an eviction, unpaid medical bills, or debts not secured by property. Include these debts in the filing. 2. Obtain all necessary documents: Gather all the documents associated with your claim. Having all the documentation prevents the creditor from pursuing legal action or obtaining a judgment against you. Schedule F requires the following information to be entered in eight columns from left to right: 1. Creditor's name 2. Mailing address 3. Zip code 4. Account number of each debt 5. Mention if there are any co-debtors attached to the debts 6. Date of the claim 7. Consideration for the claim 8. Month when the account was opened After entering this information, label the debts as contingent, unliquidated, or disputed in the appropriate columns. Finally, enter the total amount of liability in the amount of claims section. Schedule F consists of three pages, but additional pages can be added if necessary. For more information and videos, visit laws.com.

Award-winning PDF software

Schedule F partnership Form: What You Should Know

Farming. Individuals who operate a farming partnership will be taxed on the partnership's net income and losses Individuals who live and operate a farm under the direct supervision and control of a farm or forestry operation manager, but whose farm activities are not related to agriculture, are not expected to report under this form of return. Individuals who operate under the direct supervision and control of a non-farm business and who do not own or operate a non-farm business, are expected to keep a separate schedule of farm activity to document their farm activities and have an individual account separate from their individual taxpayer account. If a farm is not organized under these tax rules, a separate Schedule F return can be filed on Schedule F(Form 1040) if the individual uses Schedule F and is not expected to pay tax on his farm income through the non-farm business. Use the chart below to determine when you can use Schedule F. You are considered to have farm income and expenses to report Schedule F if: Your income from agricultural products, livestock, poultry, etc. comes from farming, and you have income from your share of the operation; You are married. Your spouse has income and expenses. Your spouse's farm earnings and expenses are included on the same line as your own. You are single and your total farm, livestock and poultry income and net farm losses are less than 1,800 for 2018.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040 (Schedule F), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040 (Schedule F) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040 (Schedule F) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040 (Schedule F) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Schedule F partnership